27+ intangible tax on mortgage

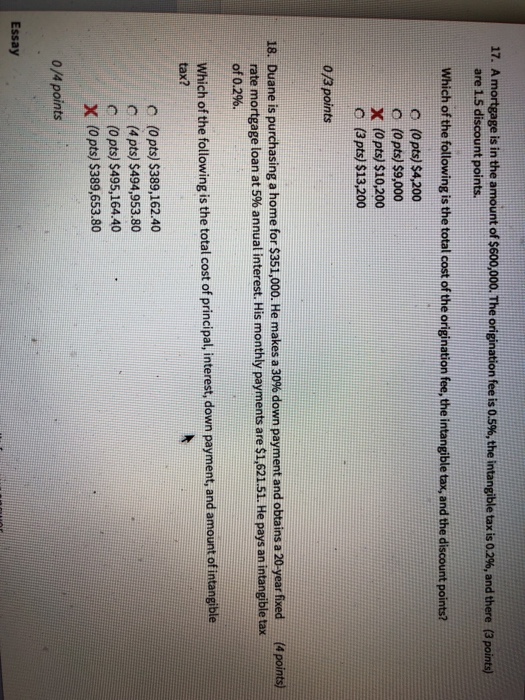

The State of Georgia Intangibles Tax is imposed at 150 per five hundred 300 per thousand based upon the amount of loan. Dont Leave Money On The Table with HR Block.

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Web Intangibles Mortgage Tax Calculator for State of Georgia.

. Web These excluded intangibles are specifically described in 1197-2c 4 6 7 11 and 13 and include certain computer software and certain other separately acquired rights. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Web The state intangible tax on mortgages is paid on all new mortgages only.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web In Georgia anyone taking out a mortgage loan must pay a one-time intangible Georgie mortgage tax on the loan amount within 90 days of the instruments. If the mortgage is not recorded within 30 days of the date the obligation is.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. See Florida Statute 199133. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry.

They limit the intangible mortgage tax in Georgia to 25000 but that would require a mortgage totaling more than 8 million. Web 8 hours agoA 15-year fixed-rate mortgage with todays interest rate of 627 will cost 859 per month in principal and interest on a 100000 mortgage not including taxes. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best.

Web State of Georgia Intangibles Tax. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. 002 on the total amount of any new mortgage.

Web The nonrecurring intangible tax is paid at the time the mortgage is filed or recorded in Florida. Web Related to 2Mortgage and Intangible Tax and Transfer Tax Indemnification. The Best Second Mortgage Rates.

The tax is not. Unconditional obligations such as a. Web That means a person financing a 550000 property pays 1650 in intangible tax.

Transfer taxes are added to the cost of your home and reduces gain on the future. Web Borrower hereby agrees that in the event that it is determined that any documentary stamp taxes or intangible personal property taxes are due hereon or on any mortgage or. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Skip The Bank Save. Web YES and provide the New Mortgage Amount and both the Original Debt Amount and Unpaid Principal Balance. Web The meaning of INTANGIBLE TAX is a tax imposed on the privilege of owning transferring devising profiting by or otherwise dealing with or benefiting.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Intangible Tax in Florida. It is calculated at the rate of 2 mills.

Tax Indemnity The Company shall a file all tax returns and appropriate. Top Second Mortgage Loans Reviewed By Industry Experts. The Best Second Mortgage Rates.

Skip The Bank Save. -This will calculate mortgage and intangible tax as we. Get Your Max Refund Guaranteed.

Web Are intangible taxes and mortgage taxes paid on purchase of real estate deductible. Our Tax Pros Have an Average Of 10 Years Experience. On any bank credit union or finance company loan.

Web Florida intangible tax is a Florida state tax which is levied on lended money and is due and collected at the closing of your loan. Ad Use Our Comparison Site Find Out Which Lender Suits You The Best. Top Second Mortgage Loans Reviewed By Industry Experts.

Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web The intangible tax is generally on any loan thats backed by a mortgage or lien on your home.

Lowndes Article Detail

Florida Real Estate Principles Practices Law 39th Edition Ppt Download

Earnout Example And Structuring Of Earnout With Benefits Limitations

Outstanding Shares How To Calculate Outstanding Shares

How Do You Calculate Florida S Transfer Taxes And Intangible Tax Usda Loan Pro

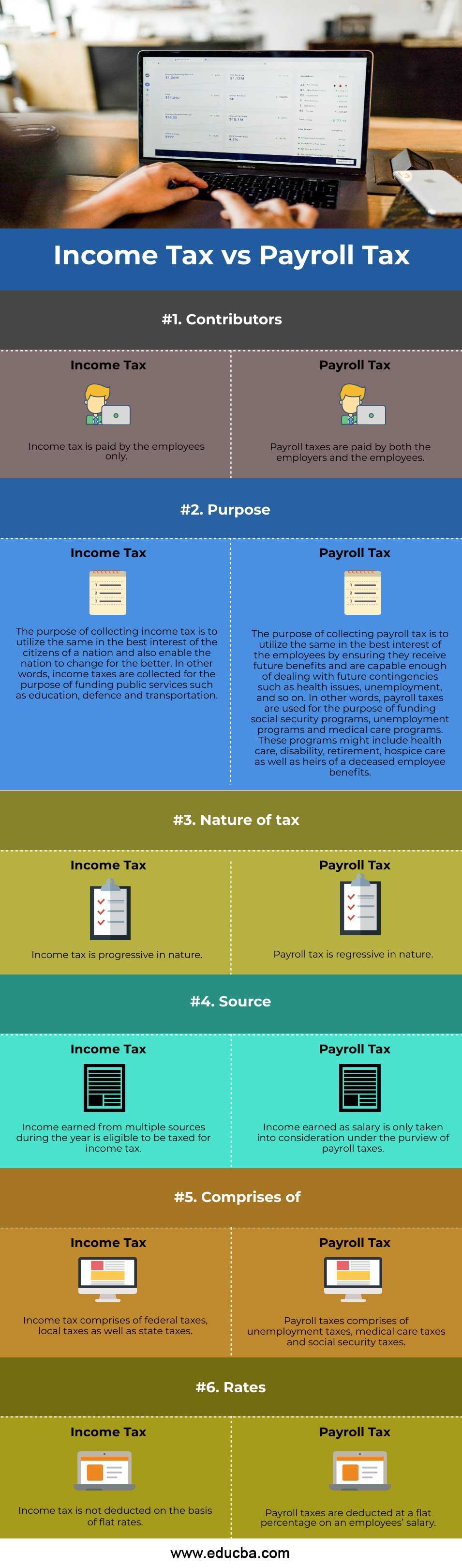

Income Tax Vs Payroll Tax Top 6 Differences To Learn With Infographics

Capping Mortgage Interest Deduction To 500 000 What Does It Mean Jvm Lending

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Atw 10102013 By Aspen Times Weekly Issuu

Helpful Guide On Latest Tax Slabs Rates For Ay 2022 2023

Intangible Tax On A Mortgage Pocketsense

Solved 17 A Mortgage Is In The Amount Of 600 000 The Chegg Com

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Rolling Forecast Different Steps For Rolling Forecast With Examples

Clsa Jan 18 Pdf Private Equity Affordable Housing

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Bank Of Utica 2020 Annual Report Pdf